Types of Fraud

Learn about the different types of fraud and the problems they can cause

The Modern Face of Fraud

Rapid innovation has led to commercial transactions becoming both more global and more virtual. At the same time, the threat of financial crimes has increased at exponential rates as innovation in the fraud space outpaces the capabilities of technology to keep pace. One result of this conflict is more than ten straight years of consistent growth in forgery-related fraud. Worldwide financial losses resulting from counterfeit fraud are mounting, threatening not only individual and corporate profits but also jeopardizing international markets and governments.

The threat is particularly acute in the realm of forged monetary instruments and identity documents. The evolution of sophisticated printers, computer software and other technological factors has increased the capacity of non-professional counterfeiters to create realistic fake documents and avoid detection by regulators and law enforcement. This, in turn, has spurred a cottage industry of outlaw organizations of counterfeiters - which in turn has flooded the market with forged documents for the purpose of defrauding the public.

Best Practices in Fraud Prevention

The most appropriate fraud prevention solutions and strategies will vary, depending on the transactional environment of the business. Through many years of experience in providing fraud prevention solutions to Fortune 100 clients such as Bank of America, JP Morgan-Chase, Sears, Macys, Yum! Brands, Kroger and many others, FraudFighter has found that there are three general best practices in fraud prevention that every business should take in order to prevent losses resulting from fraud.

Fraud Prevention Steps:

- Identify Your Vulnerabilities

- Design a Solution

- Implement the Solution and Train Employees

Best–Practice Fraud Prevention Solutions

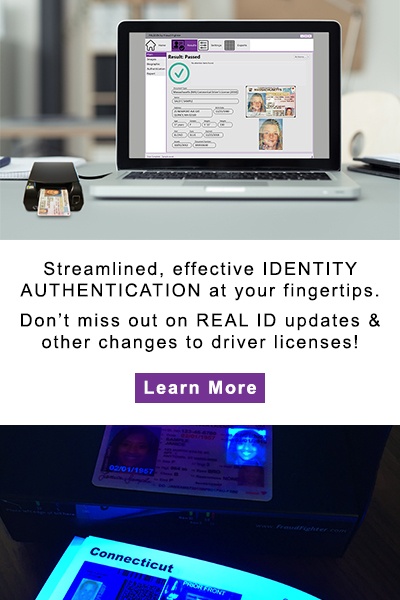

Fraud Fighter™ best–practice solutions strive to realize the concept of ‘fraud prevention’ which begins with a complete and consolidated view of fraud risks as well as the regulatory framework facing each enterprise. Our experienced team of fraud prevention consultants, can recommend a well–suited, prudent risk mitigation plan for each client designed to protect their business and its valued customers across its business lines.

With fraudulent attacks on the rise and mounting regulatory pressures, institutions of all sizes continue to rely on Fraud Fighter’s™ multi–layered solutions, services and world–class technologies that work in concert to help them excel in the detection and prevention of counterfeit document crime by focusing efforts to:

- Control risk end–to–end with prevention, detection, and compliance

- Prevent Negotiable Instrument Fraud from existing and future payment types

- Fight ID-related fraud while complying with federal regulations regarding ID verification and maintenance of customer identity records

- Optimize compliance to reduce regulatory pressures and falling revenues

- Maximize Return on Investment from leading cost–of–ownership model that delivers a measurable reduction in annual losses from fraud

- Improve operational efficiency through enhanced detection capabilities and streamlined workflow

Want To Protect Your Business From Fraud?

Our team of fraud prevention specialists is here to guide and provide support for all your fraud prevention needs!